Winter 2025: Barriers Broken

Breaking Barriers Campaign Newsletter

You’re Invited to March Virtual Lottery Day

Join CSFP on March 14, 2025 for the happiest day of the year! CSFP’s March Lottery Day event will be hosted from 9:00 a.m. – 10:00 a.m. via Zoom.

During this event, CSFP supporters, volunteers, and staff come together to share the good news with families who are receiving scholarships. The event will include a virtual townhall with President & CEO Keisha Jordan, a Q&A with a CSFP parent and school administrator, followed by the option for volunteers to call new scholarship recipients and give them the good news that they were selected in CSFP’s scholarship lottery for awards for the 25-26 school year.

Want to know what Lottery Day is like? Check out this video from CSFP Board Member, Leanne Clancy, who shares her experience making calls during CSFP’s Lottery Day event in December.

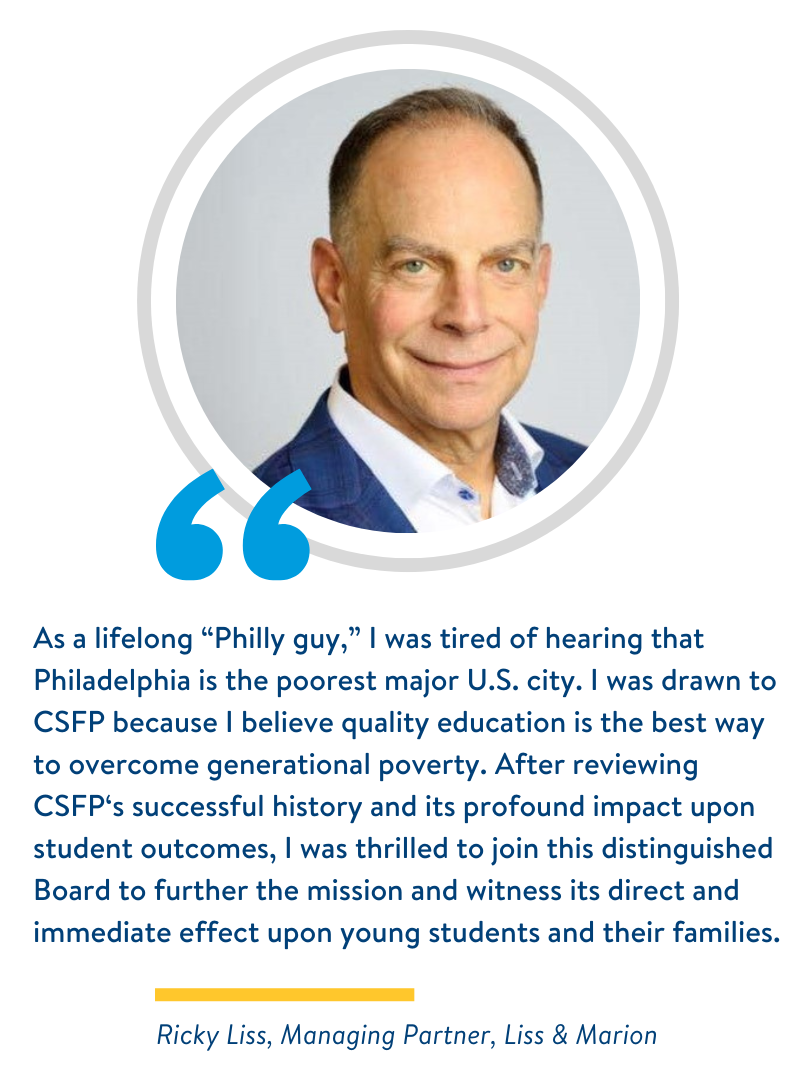

CSFP Welcomes New Board Members

Please join CSFP to welcome our two newest board members, Ricky Liss and Zeke James, to serve three-year terms on our Board of Directors. The organization is thrilled to have such respected and knowledgeable individuals to guide the organization through their leadership.

Ricky is the founder and managing partner of Liss & Marion, P.C., a successful regional law firm. In addition to his law practice, Ricky is a co-founder of and General Counsel for Hightop Real Estate and Development LLC., real estate development firm focused on the acquisition, investment, development, and management of commercial and residential real estate throughout the Greater Philadelphia region. He has worked with various non-profit organizations in the Philadelphia region and advocates for a diverse client population in a wide range of legal matters.

Zeke James is the National Head of Advisor Acquisition and Development at Fidelity Charitable. Zeke leads a national team of charitable planning consultants who introduce innovative philanthropic strategies, including Private Equity, Alternative Investments, Corporate vehicles, and more. Zeke has extensive expertise in wealth management, institutional trading, and 401(k) sales, having held leadership roles at Vanguard, Wells Fargo Investments, JPMorgan Chase, and Merrill Lynch.

Supporter Spotlight: Smart Philanthropy Through Tax Credit Giving

SD Associates PC is a leading tax and financial services firm, located in Elkins Park, with a desire to give back to the community. In 2024, CSFP hosted a lunch and learn event at the SD Associates PC office to present information to their staff regarding Pennsylvania’s Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) programs. The firm’s co-founder and partner emeritus, Howard Siegal, identified two clients who would be a great fit for the program. One of these clients had recently sold a privately held company and Howard connected them with CSFP so that this individual could make a real difference for Philly kids by contributing to a CSFP-managed Special Purpose Entity (SPE). After communicating with Howard’s second client, CSFP learned that this individual has a great passion for local education. Both of Howard’s clients joined CSFP-managed SPE’s, excited that a program that is beneficial for them will also improve the lives of Philadelphia students.

“The work that the staff of CSFP provides is a true benefit to the city and all of its residents, in addition to changing children’s and their families lives for the better.” ~ Howard Siegal

CSFP Joins the School Choice Conversation

In case you missed it, CSFP’s President & CEO Keisha Jordan officially launched a LinkedIn Blog. This blog will enable CSFP to comment on the school choice landscape, share the importance of scholarships, and inform CSFP’s network about how local and national school choice initiatives impact Philadelphians. Keisha will regularly post blogs to contribute to conversations around education; follow or connect with her on LinkedIn to get all the latest news.

Her first blog explains what school choice is: https://www.linkedin.com/pulse/what-school-choice-keisha-jordan-grm7e/?trackingId=F%2BUD2LGeSROtPPDg6fdV7Q%3D%3D

K-1’s – What SPE Donors Need To Know Now

If you are a member of a CSFP SPE, keep an eye on your inboxes for your K-1 forms. Digital copies of these forms will be delivered to you in the first business week of March via a secure email portal. Hard copies will also be sent via mail.

For corporate entities that give through the tax credit program, May 15 is the date to re-apply for your credits. CSFP can manage the application on your behalf, if you are interested. If you have questions about your K-1 or need assistance with a 2025 application, please contact Kurt Fedde.

We still have space left in our Spring Special Purpose Entities (SPE)! If you or your business have tax liability in Pennsylvania, want CSFP to manage the details of your PA tax credit giving, and would like to have a meaningful impact on the lives of Philly kids, please contact Meghan McCormick for more information.

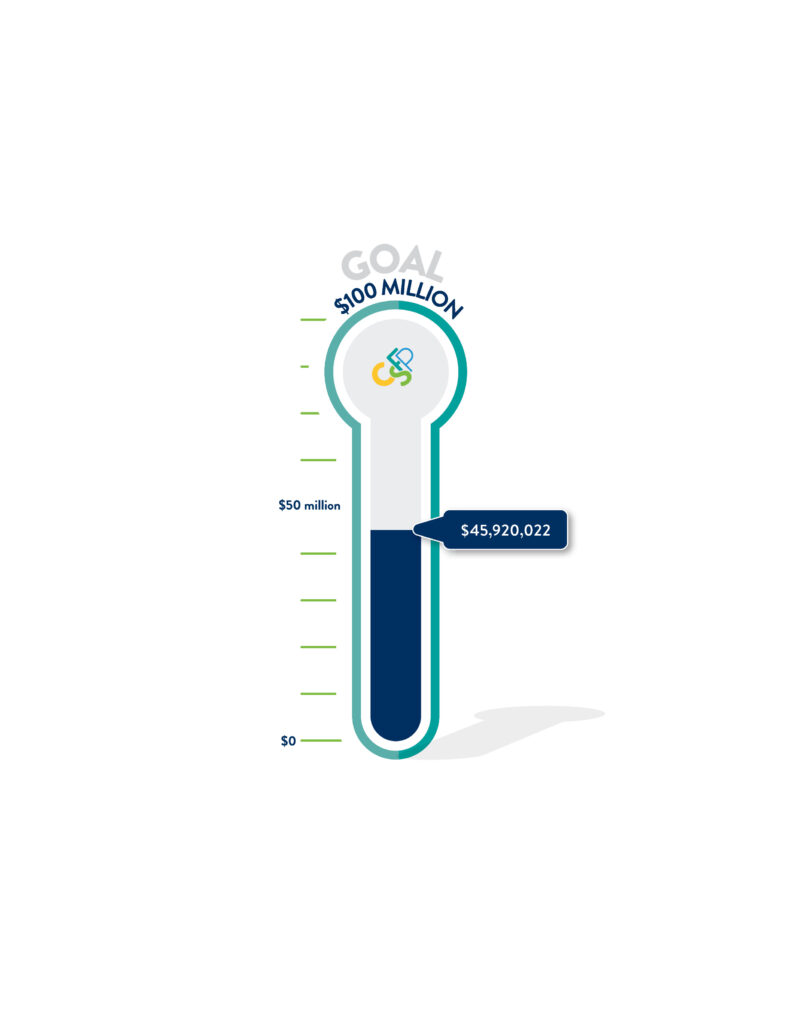

Campaign Updates

Breaking Barriers Impact

The Breaking Barriers Campaign focuses on several different key initiatives, including increasing the number of students served, removing the four-year scholarship limit, and retaining more student scholars. We have steadily increased the number of students served, while also continuing to fund the students who remained in our program. Approximately three years into the campaign, parents continue to share how happy they are knowing that their scholarship carries their student(s) through 8th grade. One parent shared the below:

“I thank this beautiful organization of scholarships for children, and I am very grateful for all the support they gave my daughter over the course of the eight years she was in a Catholic school. Thanks to you she finished the 8th grade and then she will continue high school in a Catholic school. We will continue working hard so that our daughter has a better future and achieves her dreams and goals. Again, I thank you Children’s Scholarship.” ~ Adriana Barrera, CSFP Parent

We raised over $15M in commitments in 2024 through tax credits and outright giving. See our 2024 Annual Report (releasing next month) for our 2024 accomplishments!